infrastructure investment and jobs act tax provisions

The IIJA also includes several tax extensions. On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR.

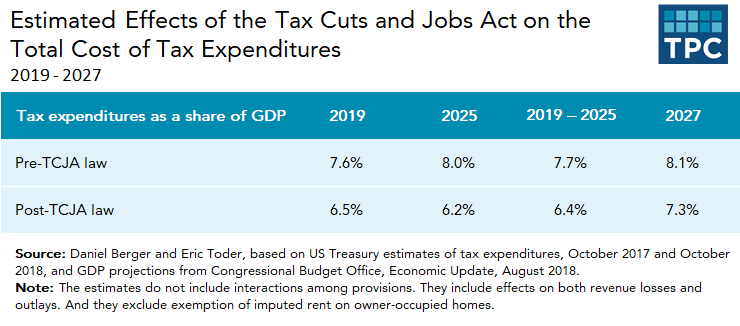

The Tax Cuts And Jobs Act Reduced Tax Expenditures But By Much Less Than The 1986 Tax Reform Act Tax Policy Center

The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

. On November 15 2021 President Biden signed into law the Infrastructure Investment and Jobs Act Public Law 117-58 which is also known as the Bipartisan. Almost three months after it passed the US. Extends several excise taxes used to fund highway spending 2.

Expands certain I See more. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. The legislation includes tax-related.

Tax Resolution Nationwide for 36 years. Highway cost allocation study. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy.

Allows private activity bonds for qualified broadband projects and carbon dioxide capture facilities 4. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known. The BBBA could for.

The BBBA could for. Extends pension funding relief 5. Almost three months after it passed the US.

Infrastructure Investment and Jobs Act. The IIJA terminates the Employee Retention Credit ERC created by the CARES Act earlier than originally planned. The Infrastructure Investment and Jobs Act IIJA signed into law on November 15 contains the largest single investment in carbon management provisions since the.

Roads bridges and major projects. Tax-related provisions in the Infrastructure Investment and Jobs Act. 3684 the Infrastructure Investment and Jobs Act.

If you have questions about year-end tax planning please contact a member of your DGC client service team or Stephen Minson CPA MST at 781-937-5120. Among other provisions this bill provides new funding for infrastructure projects including for. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

Active transportation infrastructure investment program. Almost three months after it passed the US. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known.

The American Rescue Plan Act ARPA had extended the credit. We can help you figure out all Tax Relief available to you including but not limited to the IRS Fresh Start Program. The vote was 228 to 206.

3684 by a vote of 228-206 with the support of 13 RepublicansThe Senate passed the bill in. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known as the bipartisan. House of Representatives tonight passed HR.

Almost three months after it passed the US. Almost three months after it passed the US. The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development grant programs and industry-specific.

Extends and modifies certain Superfund excise taxes 3. The Infrastructure Investment and Jobs Act Includes Tax-Related Provisions You Will Want To Know About.

Tax Related Provisions Included In The Infrastructure Investment And Jobs Act Gorfine Schiller Gardyn

Trump Tax Reform 2017 The Tax Cuts And Jobs Act Explained

Tax Highlights From The Infrastructure Investment And Jobs Act Perkins Co

Infrastructure Investment And Jobs Act Includes Several Tax Provisions With Little Fanfare

Infrastructure Investment And Jobs Act Of 2021 Ballotpedia

Infrastructure Investment And Jobs Act Ey Us

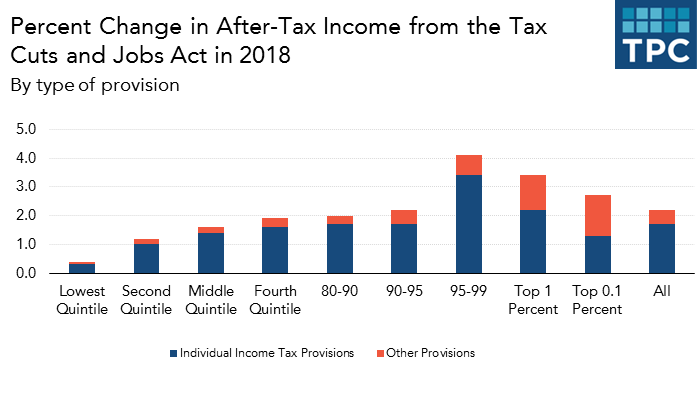

Most Taxpayers Benefits Come Mainly From The Tcja S Individual Provisions But The Rich Get Much Of Their Tax Cuts From Corporate Changes Tax Policy Center

It S Time For States To Invest In Infrastructure Center On Budget And Policy Priorities

Infrastructure Investment And Jobs Act Ey Us

:max_bytes(150000):strip_icc()/1Birdseye-MarketBridgeBrickBridgeParkPrecinctMasterplan-97e77170018d413a958d29bc5dfaddaa.jpg)

Infrastructure Investment And Jobs Act Definition

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Rji International Cpas

Infrastructure Investment And Jobs Act Ey Us

Infrastructure Investment And Jobs Act Iija Implementation Resources

The Infrastructure Investment Jobs Act Includes Tax Related Provisions You Ll Want To Know About Jones Roth Cpas Business Advisors

Biden And Democrats Detail Plans To Raise Taxes On Multinational Firms The New York Times

Us Senate Passes Bipartisan Infrastructure Bill Awaits House Action S P Global Market Intelligence

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Doeren Mayhew Cpas

Infrastructure Bill Includes Some Tax Provisions Accounting Today